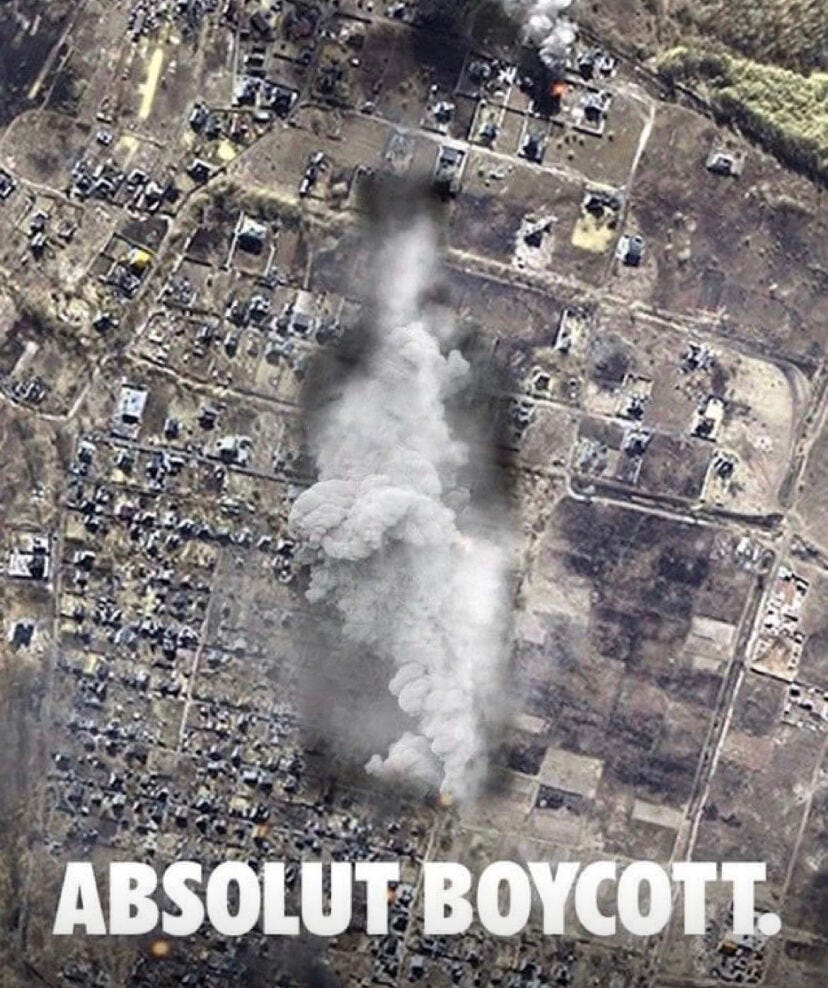

PAIRS TRADE IDEA: Absolut Boycott - How much alpha is there in an (attempted) consumer boycott?

(Long Diageo : Short Pernod Ricard)

Pernod Ricard (RI) has resumed export to Russia causing widespread protests and calls for a boycott of its brands including Absolut Vodka, Ballantine's, Chivas Regal, Jameson and Beefeater.

The resumption of exports is motivated with concern for local workers.

SHORT PERNOD RICARD

❌ Now comments encouraging consumers to boycott are spreding across social media, with some big-name restaurateurs lending their support.

❌ Before the war, Russia accounted for around 7% of RI's total sales. All that is not likely to return on day one.

Sure there's some pent-up demand. But the Russian consumer is likely weak (although the Rouble has had a surprising development in the past year).

Don’t miss our Template for Quick and Simplified Financial Modeling and Valuation

❌ Depending on how much momentum this sought-after boycott manages to build, sales of the aforementioned brands are likely to suffer. But how much is hard to say.

Pernod Rickard is a +50 BN EUR market cap company. So it might not move the needle much.

BUT, in consumer products incremental margin is an important concept. A large part of the cost base relates to marketing (22% of OPEX), fixed production cost and structure, rather than per unit costs, meaning that a slight slowdown in sales can impact profitability hard.

❌ RI will also likely to suffer some ESG-related blowback.

LONG DIAGEO

On the other hand RI's main competitor Diageo (DEO) with brands such as Smirnoff, Johnnie Walker, Guinness, Baileys and J&B, announced it would pull out of Russia shortly after the outbreak of the war and has not returned to Russia yet.

✅ DEO has posted robust sales growth (+18%), an organic operating margin expansion, productivity savings and a favorable currency impact that aided first-half fiscal 2023 results.

Price/mix has gained from a positive mix due to the robust growth in super-premium-plus brands, particularly Scotch, Tequila and Chinese white spirits.

✅ DEO’s margin trend is favorable thanks to premiumization efforts, pricing actions and supply productivity savings, which mostly offset the cost inflation.

✅ DEO management also posted an optimistic outlook for the medium to long term.

✅ Concerns about inflationary pressure, weaker consumer spending, and increased freight costs are neutral in this pairs trade.

✅ Also, Buffet enthusiasts would be encouraged by the fact that DEO is (a very small) part of Berkshire Hathaway's portfolio.

The RI share now trades at 16.2x EV/EBITDA '23e similar to DEO at 16.7x '23e and sector average at 12x. Now RI is up 6% in the past 12 months, and DEO down 11% in the past year.

Remind me to revisit this trade in 6-12 months.

Lastly, in this idea you can affect the outcome, in a very small but meaningful way. 🍸😎

Any thoughts on this?

Disclaimer:

The information on this website is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.