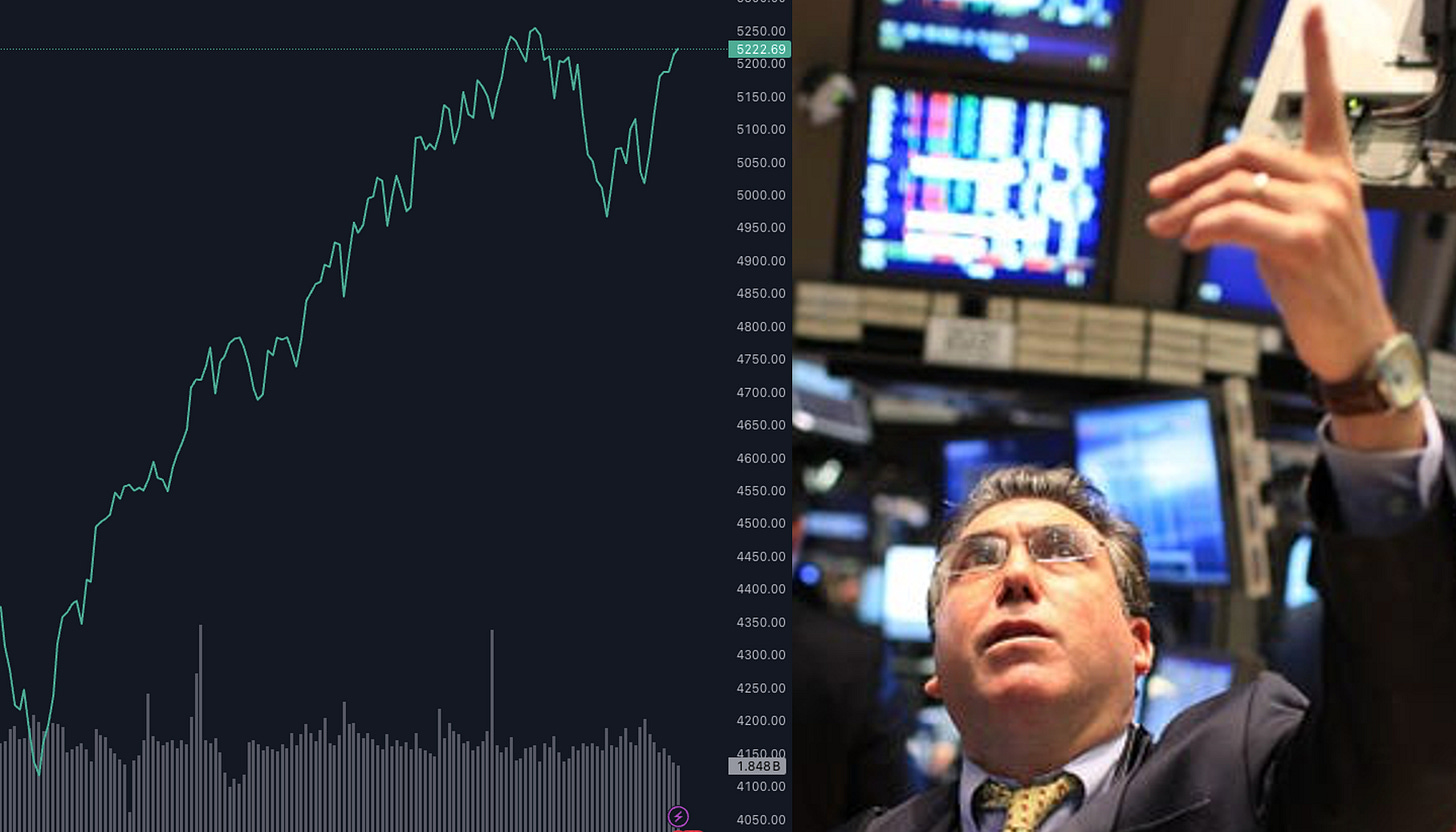

Five reasons we'll see new ATHs in the US soon

Despite a more mixed macroeconomic picture, we see five factors that offer robust support for new ATHs on the SPX in the near future.

1/ Solid support from earnings: Now 83% of S&P500 have reported and 79% of them beat EPS expectations. Q1 saw rising profit margins and EPS revisions have improved. 12-month forward EPS hit a new high for the SPY at $255.

2/ Themes > Macro: While the continued uptick in the 10-year to 4.5% is not supportive for stocks, the market has already told us that in the short- to medium term, macro fundamentals are subordinate to themes, and right now the driving theme is stable earnings growth with a slight rotation from Tech to Materials, with Small Caps (RTY) waiting around the corner to pick up the baton.

Also, stocks still does not look overly expensive compared with bonds, as earnings yield as relative to 10-year Treasury yield is in the middle of the historical range, going back to the 1960s, according to Fidelity.

3/ Solid technical picture: It's usually a good market as long as the index is trading above the 21-day exponential moving average. On May 3, the S&P 500 broke above that line.

Also, historically when the DJIA has been up more than 2% through first third of May, rest of May has been good.

NYSE and SP500 Advance/Decline lines are at new highs, which is worth noticing as breadth leads price. Small cap is near a 52-week high.

4/ DJIA 40,000 only 1.2% away: As of Friday close, the Dow Jones Index is only 1.2% away from 40,000. While not an important number in itself, it has tremendous psychological value and it is very unlikely that the market will leave that level untouched and sustainably move down from here.

5/ Supportive positioning: In April, the NAAIM Index (National Association of Active Investment Managers) took a dive from previous 105-level down to 60-65 level. This index represents the average exposure to U.S. equity markets reported by its member firms. Although is has seen a steep recovery since, it has not reclaimed previous highs, now at 91.6, suggesting positioning could still support another leg up.

Lastly however, it's worth keeping in mind that we have a busy macro week ahead, with Economic Surprise Index below zero for the first time in a while. We will follow closely the NY Fed Inflation Expectations Survey today Monday, NFIB Small Business and PPI on Tuesday, and a bunch of other macro statistics including CPI and Retail Sales on Wednesday and Thursday.