Can Cyclical be weeded out from Secular Industrial growth?

A booming copper price signals a strong economy, this time largely driven by secular factors. Here we try to weed out the plain-vanilla cyclicals from the secular growth driven industry stocks.

Investing in industrial stocks only makes sense if you are bullish on GDP and Industrial Production. If you're not, avoiding them is straightforward. But today there more to it than this narrow cyclical view.

The Mag 7 and Big Tech have been all the rage lately, and rightly so. Tech plays a crucial role for the global economy. But it cannot do it alone (not yet at least). Technology has come to rely heavily, and be closely intertwined with the Industrial sector.

Today, a lot of industrial activity is not longer about blast furnaces and brute force, but more about clean rooms, precision engineering, deep logic and hyper-precision.

Despite digital advancements, physical infrastructure remains essential. We need modern factories, efficient supply chains, and robust infrastructure to support the digital world. Moreover, as we move forward, environmentally sustainable methods are becoming increasingly important.

While it might seem straightforward to choose an industrial ETF, there are significant nuances when it comes to cyclical and secular growth components between different ETFs. With a sector, top-down approach, these can be difficult to unbundle. But here we're going to make a try.

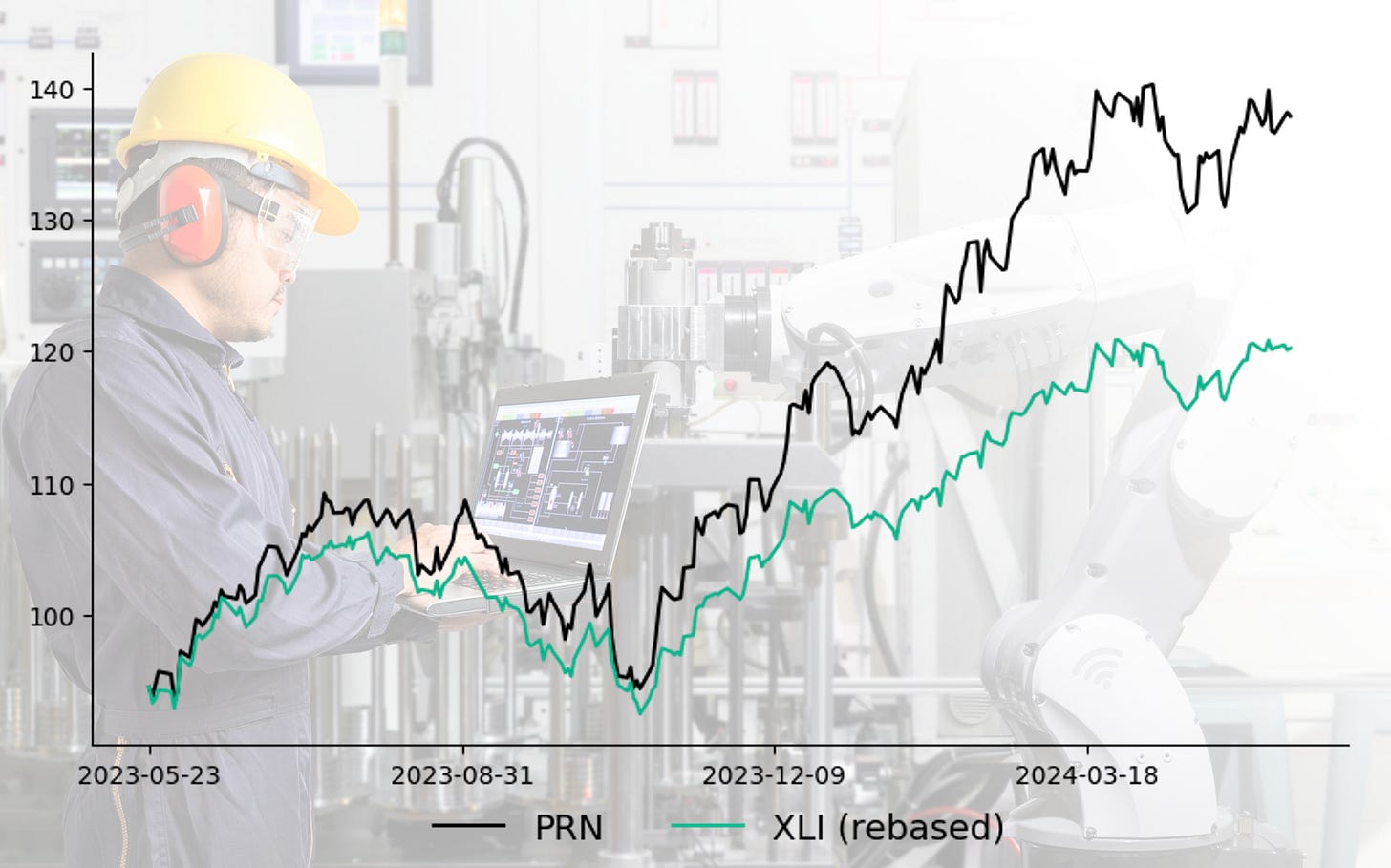

Standard XLI vs Momentum PRN

The premier industrial sector ETF, the SPDR Industrial Select Sector ETF (XLI), for example, includes companies outside traditional manufacturing, like transportation firms, which make up a significant portion of its portfolio. While these firms are important, they don’t align with the secular growth theme that we're now trying to get exposure to.

Instead, we look at the Invesco Dorsey Wright Industrials Momentum ETF (PRN). Although technically a passive fund, PRN tracks an index designed for superior outcomes using a momentum model that considers stock price strength over various periods.

Momentum can be risky on its own, as it might lead to investing in a hot area just as it’s about to decline. However, when combined with other factors, it can be a powerful indicator that the market favors certain stocks. This added support has given PRN a notable edge over XLI.

Momentum Score and composition

Looking only at price action, it's clear that PRN has done markedly better in 2024 than the XLI. However, short interest is rising in PRN constituents, Net Buy/Sell recommendations from sell-side analysts have turned negative in the past 3 months, as has insider activity. Other indicators such as long term price trend and strength look better while constituents' volatility have come down.

As for XLI we note significant pick-up in insider activity, most notably insider purchases in RTX Corporation (former Raytheon, which is not surprising given the increased geopolitical uncertainty over the past year), and legacy industrial giants Honeywell and Caterpillar.

Cannot escape cyclicality

Despite this careful selection, it’s essential to acknowledge the cyclical nature of the industrial sector. Even with a focus on secular growth, industrial companies are not entirely immune to economic fluctuations. If sectors like semiconductors and software feel the impact of reduced corporate spending, so too can secular industrial firms.

Disclaimer

The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Widmark Research serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

The information found on this website should not be interpreted as investment advice, nor does it express any viewpoint on the future trading prices of any securities. The opinions and information shared here should not be taken as specific guidance for making investment decisions. Investors are encouraged to conduct their own research and evaluations based on publicly available information, rather than relying on the content herein.

No Offer or Solicitation

The content, including opinions and expressions, present on this website, is not a direct or indirect offer or solicitation to buy or sell securities or financial instruments mentioned.

Forward-Looking Statements and Uncertainties

Any forward-looking statements, projections, or market forecasts contained in this content are inherently uncertain and speculative. They are based on certain assumptions and may not accurately reflect actual future events. Unforeseen events might impact the performance of discussed securities significantly. The provided information is current as of the preparation date and might not apply to future circumstances. The publisher is not obligated to correct, update, or revise the content beyond its initial publication date.

Position Disclosures

The publisher, its affiliates, and clients may hold long or short positions in the securities of companies mentioned. Such positions are subject to change without guarantee.

Liability Disclaimer

Neither the publisher nor its affiliates assume liability for any direct or consequential losses arising directly or indirectly from the use of the information provided in this content.

Consent and Agreement

By accessing the site or affiliated social media accounts, you signify your agreement to this disclaimer and the terms of use. Unauthorized reproduction of the content, whether through photocopying or other means, is unlawful and subject to legal consequences.

Website Ownership and Terms

Widmark Research is owned and operated by Incirrata. By accessing the site, you agree to adhere to the current Terms of Use and Privacy Policy. These terms are subject to potential amendments. The content on this site does not constitute an offer to buy, sell, or subscribe to securities where prohibited by law.

Regulation and Investment Guidance

Widmark Research is not an underwriter, broker-dealer, Title III crowdfunding portal, or valuation service. The site does not provide investment advice or transaction structuring.

Widmark Research does not validate the adequacy, accuracy, or completeness of information provided. Neither the publisher nor any associated parties make any warranties, explicit or implied, regarding the information's accuracy or the use of the site.

Investing in securities carries substantial risk, and investors should be prepared for potential loss. Each individual should independently assess whether to invest based on their own analysis.